Sergey Hovasapyan

Where executive finance meets investment intelligence — leveraging CPA rigor, Series 65 perspective, and CFA‑level modeling to diagnose issues from every angle and engineer high‑return solutions.

PhD

CPA

Chartered Professional Accountant

Doctor of Economics

CFA Candidate

Chartered Financial Analyst (USA)

Series 65

FINRA

First Nations Financial Services

Comprehensive financial management and reporting solutions, including:

Budgeting

Budget development, monitoring, and variance analysis

Accounting Set UP

Full‑cycle accounting and reporting setup for all programs and departments.

Audit Prepration and Support

Financial statement preparation and audit readiness

Investments

Investment strategy design and performance evaluation

Left to right: Claire Sault, Chief; Sergey Hovasapyan, CFO; Leslie Maracle, Councillor — Mississaugas of the Credit First Nation, ON.

Get in touch

To inquire about or book First Nations financial services, please complete the form below or email us directly at sergey.hovasapyan@gmail.com

Investment Research

AlphaLens Analytics is a separate research brand operated by me, offering a subscription-based, ranked stock list built on independent analysis.

Let us be your quantitative edge. We handle the analysis, you execute with clarity.

Essential Tier

Get 24 top-ranked stocks each month through Alpha Yield, Alpha Edge, or Alpha Core—choose your strategy: high-income, high-upside, or undervalued. For maximum coverage, See the comparison table for a detailed breakdown.

The stock list remains consistent from one month to another and is only adjusted when an existing holding becomes overvalued or fails to meet our quality criteria, in which case it is replaced with a better option. In rare instances, we may issue exit notifications when trends appear exhausted or when a major global event poses significant downside risk to the market.

Perfect for investors who prefer steady, long-term growth over short-term trading.

Institutional Tier

The Institutional Tier offers a broad list of selected assets—including stocks, crypto, commodities, indices, and currencies. Powered by our proprietary Kernel Algorithm™, this tier delivers early-stage buy alerts—signals designed to capture trends at their very inception, maximizing potential upside while inherently increasing risk.

To manage this elevated volatility, each trade alert includes a stop-loss price level, and positions are actively monitored with early-exit notifications when trends appear exhausted or invalidated—often before a stop-loss is triggered.

This plan features daily updates and frequent portfolio rotation, providing exposure to fast-moving opportunities across global markets.

Unlike previous tiers, the Institutional Tier requires active involvement and quick decision-making, suited for those who approach trading as a professional, high-intensity pursuit.

Active Investor Tier

Dynamic ranking of top-performing stocks powered by our proprietary Kernel Algorithms—an adaptive market-timing system engineered to identify early trend shifts and short-lived opportunities. Unlike our Passive-tier strategies, where stock selections remain largely consistent month to month, this tier continuously updates and re-ranks its portfolio to stay aligned with evolving market dynamics.

Designed for experienced investors seeking to maximize potential returns through data-driven, high-frequency portfolio adjustments, it includes up to 20 high-volatility micro or small-cap stocks, each carrying very high risk and potentially very high reward.

To help manage this elevated volatility a stop-loss is attached, and sometimes early-exit notifications are sent—even before a stop-loss is triggered.

This tier requires significant time, attention, and active involvement.

How It All Started

This journey began when my wife started following my stock research. Over time, she noticed that the disciplined approach I used was producing results that stood out compared to what her friends were experiencing through large investment firms. She was the one who encouraged me to share my research with a wider audience — not as personalized advice, but as clear, independent insights that others could use to make more informed decisions. That encouragement became the foundation for what I’m building today.

💬 Meet My Wife

She’s a healthcare worker who falls asleep the second you mention investments.

Yet today, she’s a confident investor, running her own self-directed investment account and achieving high returns — all thanks to my simple, actionable guidance without the confusing jargon.

Her journey inspired AlphaLens Analytics: making investing clear, approachable, and actionable for everyone.

— Sergey Hovasapyan, PhD, Founder & Chief Analyst

Who Is Our Services For?

The Dedicated DIY Investor who loves researching but wants a second opinion to validate their thesis.

The Busy Professional who wants curated, high-quality ideas but doesn't have 20 hours a week to find them.

The Investing Novice who is ready to start but needs a trusted partner to learn the ropes and build confidence.

The Future-Minded Canadian who is focused on long-term goals like retirement, a home, or financial freedom and wants a smart, strategic path to get there.

Is this financial advice? Can I rely on these picks to make money?

These are two basic regulatory question you might have in mind. We want to make this absolutely clear. We do not provide personalized financial advice

Are you a registered investment adviser?

We publish independent stock research designed to help investors think clearly and act with discipline. Our work is general and not personalized to any individual’s risk tolerance, investment goals or investment horizon (individual situation). You should consider your own financial circumstances or speak with a licensed professional before making investment decisions. We are not required to register because we are a bona fide publisher of impersonal investment research.

Can I expect guaranteed returns from using AlphaLens Analytics?

Absolutely not. No legitimate investment can guarantee income or returns. Anyone claiming otherwise is misrepresenting the nature of investing. All investments carry risk, and past performance is never a guarantee of future results. All research published here is general and impersonal in nature. It does not take into account your individual risk tolerance, financial objectives, or personal circumstances. You are fully responsible for your investment decisions.

Our Analysis Process

We identify high-potential stocks using a rigorous, multi-stage strategy that filters opportunities through increasingly stringent criteria

Your Edge through Multi-Layer Analysis

AI Filtering: Our proprietary scanners source an initial batch of high-potential stocks.

Holistic Scrutiny: Each company undergoes fundamental, industry, and macroeconomic analysis.

Algorithmic Testing: Prospects are validated by our proprietary quantitative models.

Final Selection: We only share the elite stocks that pass all stages, delivering quality over quantity.

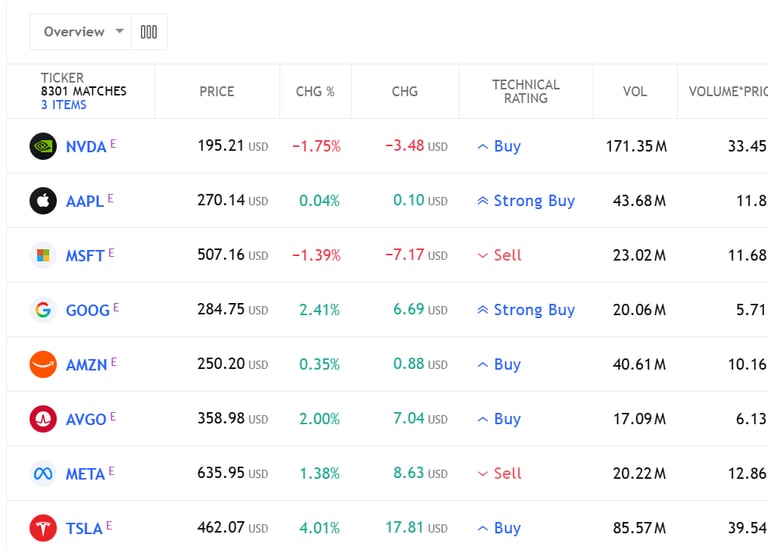

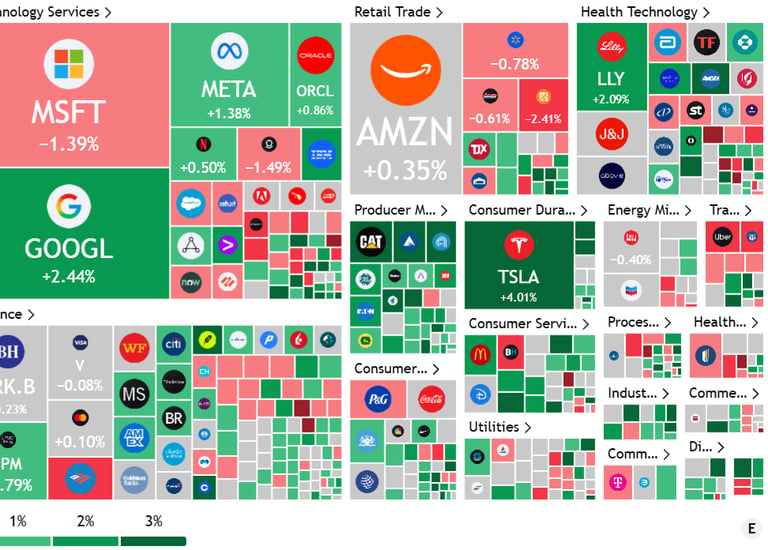

Market Overview

We’ve assembled the most useful investor tools with real‑time data—advanced interactive charts, stock screeners, and more—to give you a quick overview of the markets. Access them for free using the links below.

Currencies

Advanced market analysis tool.

Crypto

Real-time data visualization.

Stocks

See the top five gaining, losing, and most active stocks for the day

Investor Tools User Guides

This page is optimized for desktop. Some charts and tables may not display properly on mobile devices.

We empower you with the knowledge to make informed decisions for life

Great investing isn't just about picks—it's about understanding the why.

Check Our Blog where you will find tons of educational and useful information and also subscribe to our free newsletter.

📊 Real-Time Market Charts

Explore live charts and advanced tools powered by TradingView on our Investor Tools page or any of three Markets — track any stock or asset, switch between chart types, add professional indicators, and perform real-time technical analysis. Use the same tools professionals rely on — and the ones we recommend after testing them all.

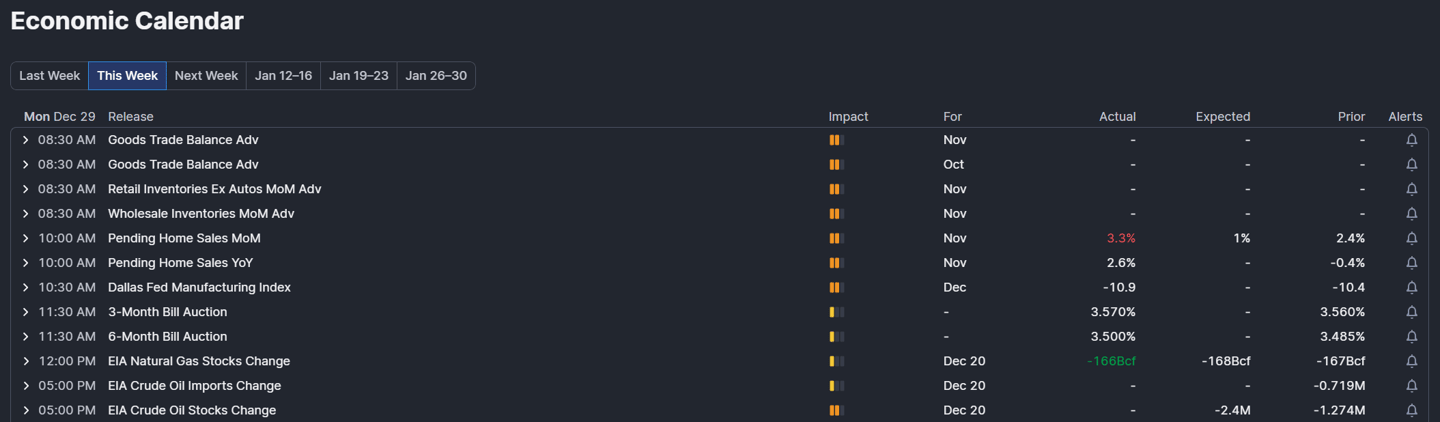

Economic Calendar

Just head to the Finviz homepage and click on the Calendar widget. From there, you can switch between economic, earnings, and dividends calendars — and explore both upcoming and historical data.